Universal vs. Term Life Insurance: Which Is Better?

TL;DR Is term or universal life insurance better?

For most Canadians, term life insurance is the better choice.

Universal life insurance only makes sense in specific situations, like estate planning, covering future taxes, or high-net-worth strategies where traditional registered accounts have already been maxed out. If this sounds like your financial situation, then lifelong coverage and tax-advantaged cash value might be a good investment.

Universal vs. term life insurance, compared

The two main differences between universal and term life insurance are how long you have insurance coverage and how much you’ll pay.

- Universal life insurance lasts your whole life. It accumulates cash value that you can use, but premium payments are a lot higher. It’s also riskier and more complex to manage.

- Term life insurance covers you for a set term, usually 10, 20, or 30 years. It’s cheaper than universal coverage, and the money you save can be invested elsewhere to save for your financial future.

“I don’t always recommend life insurance as an investment. But for a higher-net-worth client, we will often use life insurance as a savings mechanism for funds they wouldn’t otherwise use while living.” – Susan Cruikshank, Senior Tax Manager at BDO Canada LLP

Coverage duration

Universal life insurance covers you for your entire life, as long as you keep the policy funded.

- You pay premiums for life at a higher rate

- Your beneficiaries get a payout no matter when you pass away

Term life insurance covers you for a set number of years (aka, your term) and then expires. At this time, you can usually renew (at a higher cost, since you’re older) or purchase a new policy.

- Your premiums end when your term ends

- Your coverage ends when your term ends

- Your loved ones get a payout only if you die during the term

The bottom line: For most Canadians, term is a better choice to protect your family while paying off a mortgage, raising kids, or covering other financial responsibilities.

Premiums

Universal life insurance premiums are higher. They can also be adjusted within certain limits, but you need to actively manage your policy to keep it funded.

Here’s a comparison of the premiums for Term 100 permanent life insurance for two life insurance companies in Canada, PolicyMe and TD Insurance.

* Data pulled December 2025.

Term life insurance premiums are lower. They’re also fixed for the length of your term, making it the more budget-friendly and predictable choice. The coverage amount will impact your premium, too.

Let’s look at some premiums for 20-year term and 30-year term policies in Canada.

* Data pulled December 2025.

Cash value or savings component

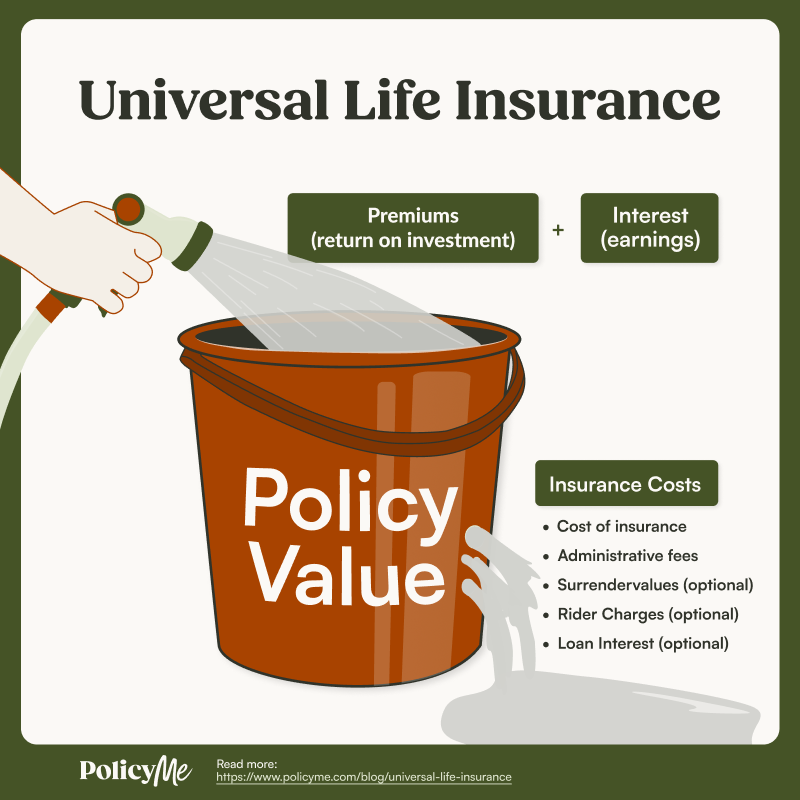

Universal life insurance policies do build a tax-deferred cash value. You can borrow against the policy’s cash value or withdraw, but this might reduce your death benefit if you don’t pay back the policy loan.

Term policies do not have a cash value or savings component. If you’re still alive when the term ends, there is no payout or cash reserve.

The bottom line: For most Canadians, the cash accrual feature of universal life insurance is actually less helpful than investing for retirement planning or setting aside cash in a high-yield savings account.

“If you buy an expensive permanent insurance plan, it’s going to take money away from saving for a down payment, which might be more important. Maybe instead, you consider a cheaper term insurance policy that will get you what you want from an insurance perspective without jeopardizing savings for retirement, for a house, or whatever it may be.” – Erik Heidebrecht, Licensed Insurance Advisor

Simplicity

Universal life insurance policies are more complicated and take active effort to maintain.

- Requires knowledge in investment/finance

- Requires time to manage the policies successfully

- Requires management for the entire duration (aka your lifetime)

Term life insurance policies require no management once you’ve purchased a policy.

- Offers various term length and coverage options

- Requires you only to pay your premiums every month

- Has the ability to renew or convert to permanent coverage at the end of the term

The bottom line: A universal life policy might be a good fit if you have the skill (and time) to manage it, or if your family has complex estate planning needs. But for most Canadians, term life insurance offers the right amount of protection with no day-to-day involvement.

Read more: The best term life insurance in Canada

Death benefit

Universal life insurance pays a death benefit whenever you die. You may be able to increase the amount, depending on the type of policy.

Term life insurance pays a guaranteed death benefit if you die during the term. Your loved ones will receive nothing if you pass away after the policy ends.

The bottom line: Consider term life insurance if you want to take care of your loved ones now and in the future. It may sound like a guaranteed payout from a universal life insurance policy is smarter, but you may be able to grow your wealth faster by opting for term coverage and investing the rest.

Types of universal vs. term life insurance

There are two main types of life insurance: permanent and term (universal is a type of permanent coverage).

There are three types of permanent life insurance policies:

- Whole life insurance: Lifelong coverage, level premiums, and cash value with guaranteed growth. It can be participating with dividends, or non-participating with no dividends.

- Universal life insurance: Lifelong coverage, flexible premiums, and a cash value investment account. There are three types of universal coverage.

- Guaranteed universal life insurance (GUL): Little or no cash value growth

- Indexed universal life insurance (IUL): Cash value tied to stock market index

- Variable universal life insurance (VUL): Cash value depends on your choice of investment options

- Term to 100: Lifelong coverage, level premiums until age 100, and no cash value.

Now let’s look at term insurance, which covers you for a specific period of time. Terms lengths vary from 5 to 40 years, but the most common terms are 10, 15, 20, 25, or 30 years.

There are two term styles:

- Level term: Premiums and death benefit stay consistent for the whole term

- Decreasing term: Premiums usually stay level while the death benefit decreases (often used to cover a mortgage)

You may also have term options, including:

- Renewability: Option to renew your coverage at the end of the term. There’s no medical exam, but premiums will increase due to your increased age.

- Convertability: Option to convert your term policy to a permanent policy without a medical exam, typically within a certain period or by a certain age.

Is term life insurance better than universal life insurance?

For most Canadians, term life insurance is better than universal life insurance. It has more advantages for you and your loved ones.

- Premiums are more cost-effective

- Fixed premiums

- Coverage better aligns with financial obligations

- Policies may be personalized

- Set-and-forget protection

Work with a financial advisor to get a life insurance quote and see what you’d pay for the coverage you need. Consider your financial needs, budget, and timeline, and then look for a company with good reviews, not just good rates.

When does universal life insurance make sense?

Universal life insurance may make sense if you:

- Have already maxed out traditional savings and investment avenues

- Have permanent dependents or other financial obligations, such as a disabled child

- Are a high-income household or have other complex estate planning needs

Universal life insurance usually does NOT make sense if you:

- Just want affordable coverage to protect your family while you’re working

- Do not want market risk or investment complexity as part of your life insurance

- Have not yet maxed out your TFSA or RRSP yet

FAQ: Universal vs. term life insurance

Bonnie Stinson is an insurance writer and researcher in Toronto with a decade of experience producing helpful, accurate content for Canadians. They have published resources for some of Canada's most innovative and consumer-trusted companies in the health, legal, and fintech sectors.

Bonnie Stinson is an insurance writer and researcher in Toronto with a decade of experience producing helpful, accurate content for Canadians. They have published resources for some of Canada's most innovative and consumer-trusted companies in the health, legal, and fintech sectors.