Is Life Insurance Worth It? Here’s the Truth

Is life insurance worth it?

By providing a tax-free death benefit to your beneficiaries after you’re gone, life insurance allows you to tie up the loose ends that death may cut short—stuff like large debts, a thriving business, growing young children, and the life you’ve built with your partner.

If you don’t have many projects on the go or you’ve undertaken sound financial planning, life insurance may not be as important. But it can still provide the means for post-life goals such as inheritances, funeral expenses, estate planning, or charitable donations.

Life insurance is worth it in Canada for those with:

- Large debts, like a mortgage balance, a business loan, or significant credit card debt

- Loved ones who depend on their income and would financially struggle without you there

- Financial goals that would be impeded by their premature death

As a rule of thumb, term life insurance is generally worthwhile for the average Canadian's financial needs.

Do I need life insurance?

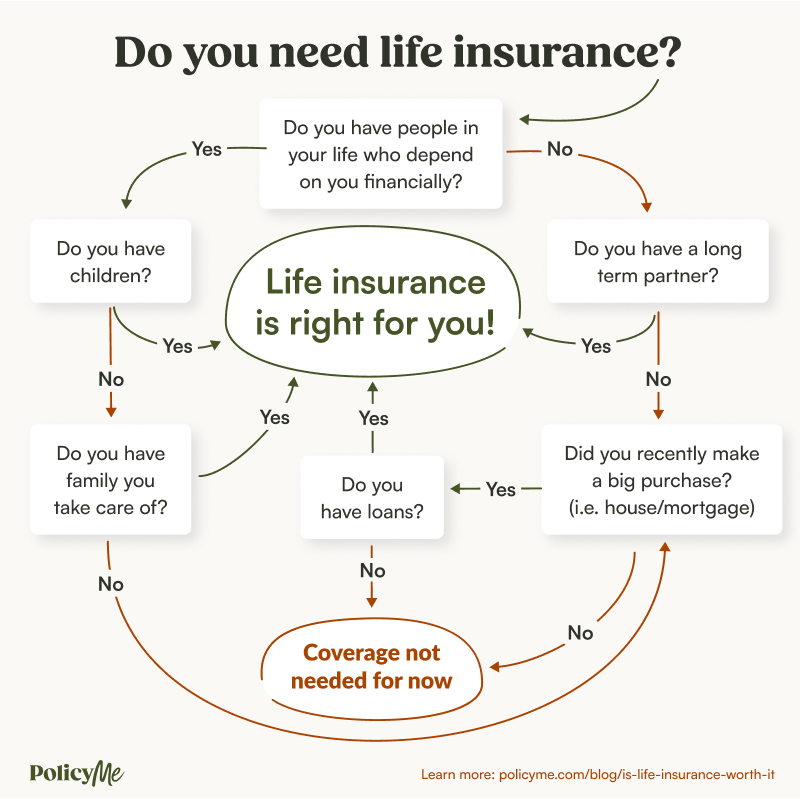

If you're not sure you need life insurance, think about this: can your loved ones take care of themselves if you're gone? To help you out, start with the image below.

Who needs life insurance?

Now that we’ve covered the three why’s of life insurance—dependents, debts, and post-life goals—it’s time to cover the who. Here are a few of the key demographics that need life insurance:

- Parents: Life insurance is an essential financial safety net for your children. It can also help to cover childcare costs, education, and even extracurriculars after you’re gone, especially if you’re a single parent.

- Homeowners: If you have an active mortgage, life insurance ensures that your debt won’t become an unmanageable burden to your loved ones if you pass away before it’s paid off.

- Business owners: Running a business comes with ongoing costs. Life insurance can make sure they’re paid even after you’re gone.

- Early career adults: If you’re building a career that promises high earnings in the future, buying life insurance at an early stage can help you lock in low rates on major protection.

- Seniors: As you’re approaching end-of-life decisions, a life insurance policy can help you leave behind financial support for your loved ones to cover final expenses including burial.

Most Canadians who need life insurance need a term policy

If you fall into one of the groups listed above, or if you have other financial obligations and goals that require a life insurance policy, you most likely need term life insurance.

“There’s an elephant in the room when it comes to life insurance,” says Andrew Ostro, co-founder and CEO of PolicyMe. The elephant: permanent life insurance.

“Many Canadians seem to believe they need permanent life insurance, but the reality is that permanent life insurance is a very specialized product that only meets the needs of a very small percentage of the population.” —Andrew Ostro, Co-Founder & CEO of PolicyMe

Permanent life insurance, including whole life insurance and universal life insurance, sounds like a great option—after all, if your coverage is permanent and a life insurance payout is guaranteed. But that’s part of the problem with permanent life insurance policies: because they cover an insured person’s entire lifetime, they come with much higher premiums than term life insurance, which only covers a set period of life, typically 10 to 30 years.

Despite the high premiums, some Canadians opt for universal or whole life insurance policies because these plans include investment features that offer tax-advantaged growth, a significant advantage if you’ve already maxed out traditional savings and investment options like TFSAs and RRSPs and want to supplement your retirement income. But unless you have a high net worth, lifelong dependents, or complex estate planning needs, a term life insurance policy with lower premiums and targeted coverage is likely the most cost-effective life insurance option.

“Buy term and invest the rest. Cover yourself when you need it most, and at the end of your term, you can reassess your coverage needs.” —Stephanie Roux, Life Insurance Advisor

How much life insurance do you need?

Not sure what type of policy you need or how much coverage to buy? PolicyMe’s free online life insurance calculator is a quick way to evaluate your life insurance needs based on your annual income, mortgage payments, retirement savings, family structure, and more.

Who doesn’t need life insurance?

People without dependents, large debts, or post-life goals (or who already have enough savings to cover them) may not need life insurance. The key is to think about your responsibilities and financial situation, because life insurance can be worth it at any age.

For example, a financially-savvy 26-year-old with medical school loans might want to lock in an affordable, 10-year term plan for the sake of their parents’ financial security. A retired couple might choose the same insurance product before embarking on a decade-long life on the road. Conversely, an office worker with three children nearing independence might decide against coverage because they have extensive savings and an excellent group insurance plan through their workplace.

“If you are out of school, don’t have any dependents, mortgage, student debt, or even a car, you probably don’t need term life insurance right now.” —Javade Williams, Life Insurance Advisor

Ask an expert: do I need life insurance?

If you’re not sure whether you need life insurance, it can help to hear from an expert. Licensed life insurance advisor Stephanie Roux shares the recommendations she made to four real-life Canadian couples and individuals facing the same question.

Elena and Feng from Burnaby, BC

Elena (31) and Feng (33) have been married for two years and hold a $500,000 mortgage together. Elena works as a financial controller, while Feng is a coordinator at a non-profit.

Is life insurance worth it for Elena and Feng?

Asma from Calgary, AB

Asma (33) is a business analyst who owns a condo and has a mortgage with $250,000 remaining. Although she makes all the payments herself, her mother was a co-signer.

Is life insurance worth it for Asma?

Laila from Regina, SK

Laila (24) is a student and only a few months away from completing her studies. To keep costs low, she attends an affordable program and lives with her working parents, who can comfortably provide for their own needs.

Is life insurance worth it for Laila?

Barb and John from Barrie, ON

Barb (58) and John (62) have grown children who just moved out. The two of them are still working to pay off their shared mortgage before retiring for good.

Is life insurance worth it for Barb and John?

According to the PolicyMe 2025 Life Insurance Gap Report, the majority of Canadians who currently have life insurance (80%) feel confident in their family’s financial security.

Ask yourself: Is life insurance worth it for me?

It’s time to do some soul-searching. If you’re not sure whether to invest in a life insurance policy, ask yourself these questions (or discuss them with your spouse):

- How many people rely on me financially? Don’t just think about legal dependents like children. Your partner, parents, or other family members might depend on your income in full or in part—or you may expect them to become dependent in the future.

- What’s my total debt, and is it shared? When you die, your outstanding debts will pass to your estate. If your assets (e.g., property, savings, and investments) aren’t enough to cover them, they could pass to anyone who shared the debt, such as a spouse or a family member who co-signed a loan.

- Could my family afford a funeral right now? Death is expensive, and so is what follows. The average cost of a burial in Canada is between $5,000 and $25,000 in Canada, while cremation costs $2,000 to $5,000.

- What financial goals am I saving for? If you’re saving up for major life plans, such as your children’s college education, keep in mind that your savings could be cut short if you died unexpectedly.

- Do I want to leave a legacy? You can leave your mark in other ways, but if you’d like to leave a sizable financial gift to your loved ones, a charitable cause, or another individual or organization, life insurance is a natural mechanism for that gift.

- How much room is in my budget? For most healthy, non-smoking adults aged 30–44, term life insurance premiums are well under $50/month—and many people pay far less. If you can fit that payment into your monthly budget, life insurance may be worth it.

If you choose to buy life insurance: Make sure that you understand the pros and cons of different types of life insurance, as well as the strengths of individual life insurance companies. Once you’ve settled on the right coverage, request life insurance quotes from a few companies to compare your eligible rates.

If you choose not to buy life insurance: If you don’t need life insurance right now, be prepared to revisit this question after any major life changes, such as the purchase of a property or the birth of a child.

FAQ: Is life insurance worth it in Canada?

Helene Fleischer is Content Marketing Manager at PolicyMe, with 9 years in content marketing and 4 in Canada’s insurance industry. She works with skilled writers and licensed insurance advisors to create useful resources that help Canadians navigate insurance decisions with confidence and clarity.

Helene Fleischer is Content Marketing Manager at PolicyMe, with 9 years in content marketing and 4 in Canada’s insurance industry. She works with skilled writers and licensed insurance advisors to create useful resources that help Canadians navigate insurance decisions with confidence and clarity.