Guide to Permanent Life Insurance in Canada

See affordable life insurance quotes from PolicyMe and other top companies.

What is permanent life insurance?

Permanent life insurance is a type of life insurance that provides lifelong coverage and a guaranteed tax-free death benefit that pays out when the insured person passes away. It typically includes a cash value component, which can act as a tax-deferred savings or investment account.

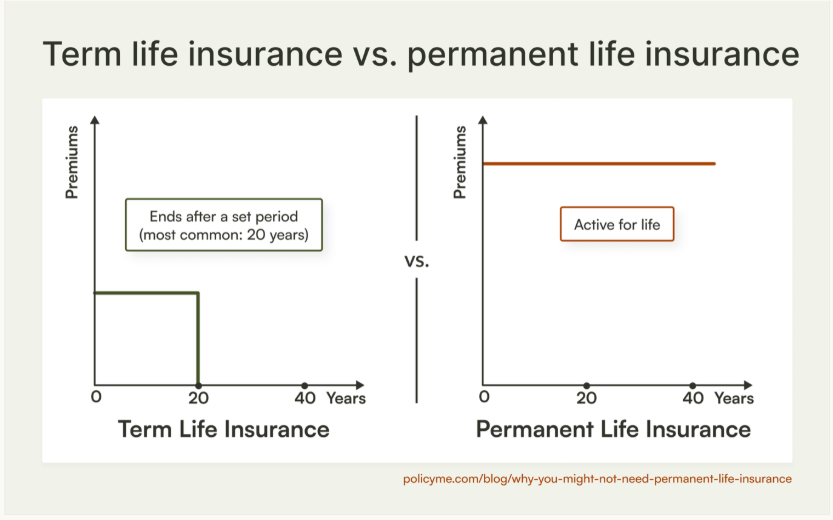

Unlike term life insurance, which offers coverage for a set period, permanent life insurance does not expire and lasts your entire life. The main caveat is that permanent life insurance is generally more expensive and complex than term life coverage, so it's only recommended to individuals who truly require lifelong coverage.

Many life insurance providers in Canada sell permanent coverage, from PolicyMe to Manulife.

Who is permanent life insurance for?

Permanent coverage can be 5 to 15 times more expensive than term life insurance, so you should only consider a permanent plan if lifelong protection aligns with your circumstances and goals.

Here are the most common situations where permanent life insurance could make sense:

- Lifelong dependents: Permanent coverage can help protect your lifelong dependents, such as a child with a disability or an adult family member who relies on you for financial support.

- Estate planning needs: High-net-worth individuals may use permanent life insurance to help cover capital gains taxes on properties, businesses, or investment portfolios.

- Business succession: Business owners can dedicate the payout of their permanent policy to fund the continuation of their business.

Permanent life insurance may not be the best fit for your coverage needs, especially if you’re looking for an affordable policy that mainly protects you during the years when your financial responsibilities are high (e.g., while paying off a mortgage or supporting your dependent children).

Outside of these cases, term life insurance is usually the simpler and more affordable choice. Term coverage can be tailored to the years when your family needs coverage the most, and the money you save from paying lower premiums can give you more financial flexibility outside of your policy, for everyday needs.

When permanent life insurance is a good fit: example scenario

Mariah is a 45-year-old parent with a 17-year-old son. Her son has a lifelong disability and will rely on her for financial support for as long as she lives.

Since her financial responsibilities won’t end when her mortgage is paid off or when her son reaches adulthood, she requires life insurance coverage that will last until she passes away.

When permanent life insurance is not a good fit: example scenario

Alexi is a 32-year-old husband and father with a new mortgage. He wants to ensure that his wife and young kids can cover living expenses and pay off the mortgage if he were to pass away.

Alexi doesn’t need lifelong coverage since his financial needs will decrease as his mortgage is paid down and his kids become financially independent. He primarily needs short-term financial protection for the next couple of decades while his responsibilities are at their highest.

Types of permanent life insurance

There are three main types of permanent life insurance products:

- Whole life insurance

- Universal life insurance

- Term-to-100 life insurance

Each policy structure offers lifetime coverage, but there are a few key differences in their savings features, flexibility, risk, and cost. Here’s a rundown of each.

Whole life insurance

A whole life insurance policy provides lifelong coverage and a guaranteed payout when you pass, but it’s unique among other permanent policies:

- Fixed premiums: Whole life premium payments are typically fixed.

- Cash value component: Whole life policies typically include a guaranteed cash value component that grows over time.

- Borrowing: The policyholder may be able to borrow against the cash value of their whole life policy.

- Cost: It’s generally the most expensive type of permanent policy, even though whole life insurance is often described as a “low-risk” permanent coverage option.

- Dividends: Participating whole life policies may include optional dividends.

Universal life insurance

Similar to whole life insurance, universal policies offer coverage that lasts for life and a guaranteed payout, no matter when you pass.

Here are the main features that differentiate universal life insurance from whole life insurance:

- Flexible premiums: Universal life premiums are flexible not fixed, meaning you may be able to adjust when and how much you pay.

- Cash value flexibility: Universal plans usually offer multiple investment options for the cash value component. So policyholders have more flexibility in where their cash value is invested, but growth isn’t guaranteed since it depends on how the investment performs.

- Borrowing: Policyholders can borrow against the cash value accumulated in a universal life policy, but this is less common and often riskier than with whole life since growth is not guaranteed.

- Cost: Universal life policies are generally less expensive than whole life policies, but they usually cost more than Term-to-100 coverage.

Term-to-100 life insurance

Term-to-100 (T100) life insurance is a simpler type of permanent life coverage that lasts for life, but it doesn’t include a savings or investment component like whole life or universal life policies. Here are the notable details that make up term-to-100 policies:

- Premiums: Term-to-100 premiums stop at age 100, but coverage continues until you pass.

- No cash value: This type of policy doesn’t offer a cash value or investment component.

- Level premiums: Premiums stay the same throughout the policy’s life.

- Cost: Term-to-100 coverage is generally cheaper than whole life or universal life insurance, but it’s still more expensive than term life coverage.

Pros & cons of permanent life insurance

Permanent life insurance has its upsides and downsides, mostly to do with cost and coverage:

Pros of permanent life insurance:

- Lifelong coverage: Your death benefit is guaranteed to payout to your beneficiaries no matter when you pass, as long as your premiums are paid.

- Financial planning support: Permanent life insurance is often used to cover estate taxes, which can’t be paid off earlier in life.

- Protects lifelong dependents: Permanent coverage can provide financial security if you support someone with a disability or other lifelong needs.

- Savings components: Whole and universal life insurance policies include a tax-deferred cash value component that can be borrowed against or used later in life.

Cons of permanent life insurance:

- High cost: Permanent policies are usually significantly more expensive than term life coverage, which can put them out of budget for some families.

- Risk of over-coverage: Most people take out a life insurance policy to protect their loved ones from the burden of steep financial responsibilities if they pass away. These responsibilities are often temporary for most families, so a permanent policy could lead to overpaying for lifelong coverage that isn’t necessary over time.

- Less financial flexibility: Higher permanent life premiums mean less money left to put towards other common goals, like saving, investing, paying down debt, or even just day-to-day expenses.

“If you buy an expensive permanent insurance plan, it’s going to take money away from saving for a down payment, which might be more important. Maybe instead, you consider a cheaper term insurance policy that will get you what you want from an insurance perspective without jeopardizing savings for retirement, for a house, or whatever it may be.” – Erik Heidebrecht, Licensed Insurance Advisor

Permanent vs. term life insurance

If you’re comparing permanent and term life insurance, here’s a simple comparison.

For most people, term life insurance is a better fit — it gives you plenty of protection with more flexibility and without overspending on unnecessary lifelong coverage.

Cost

- Permanent: 5-15x more expensive ($100 to $300 per month)

- Term: More affordable ($20 to $30 per month)

Coverage

- Permanent: Lifelong coverage

- Term: A set period (5 to 40 years) based on the time when you have financial responsibilities, then it expires (or you can renew or convert)

Flexibility

- Permanent: Less. You can borrow against some policies and you may be able to adjust the death benefit, but it’s a lifelong policy that is otherwise fixed.

- Term: More. Choose a custom term between 5 and 40 years that matches your family’s timeline

Financial freedom

- Permanent: Higher monthly premiums must be paid for life, which can interfere with retirement savings and financial freedom in old age.

- Term: Higher death benefits but lower premiums, which frees up money for other things like your children’s education, your mortgage, or retirement savings.

Overall, permanent life insurance can make sense in very specific situations, but term coverage is often the smarter and more affordable choice for the average household.

Alternatives to permanent life insurance

While permanent life insurance has its appeal, most Canadians don’t actually have lifelong insurance needs.

Term life insurance: For most people, term life insurance is the best life insurance plan. It balances affordability, flexibility, and protection while covering you and your loved ones for a set number of years when your financial responsibilities are at their peak.

Convertible term life insurance: But for people who really want to keep their options open, then you can get a term life insurance policy that’s convertible to a permanent policy in the future — with no health questions.

Here’s how convertible term life insurance can help you:

Convertibility is guaranteed insurability. It’s good for families who don’t want to pay lifelong premiums now, but want to have the option to get permanent coverage with less strict underwriting if there are chronic health issues, increased dependents, or higher income in the future that could complicate the process of buying a brand new policy when their term expires.

Just be aware that you must convert before the term expires or you reach a certain age (depending on the policy). Expect higher premiums as they’re based on your age at conversion, not your health.

Note: Convertibility is not the same as renewability.

Convert: You transform a term policy into a permanent policy with lifelong coverage. For instance, a permanent plan’s payout delivers a tax-free lump sum for your beneficiaries. It’s peace of mind in the event of premature death, so dependents don’t have to wait for retirement savings to mature.

Renew: You get another term policy with new premiums (but no medical exam). Renewable policies help you extend coverage temporarily if you still have debts and dependents relying on you, past the time you originally predicted.

“Generally between the ages of 50 and 60, where you're coming to the end of your first term and considering whether to get term into retirement age or opt in for a more expensive whole-life plan that's going to act as final expense coverage whenever you pass away. The need for insurance is not significant but you’re looking for final expense coverage.” – Erik Heidebrecht, Licensed Insurance Advisor

How much does permanent life insurance cost?

Life insurance quotes for permanent coverage can start between $100 to $300 per month, depending on the age, policy type, and coverage amount. You have to pay premiums for life, every single month.

Permanent life insurance is about 5 to 15 times more expensive than term life insurance.

* Monthly premiums based on a non-smoking female of average health for $500,000 in coverage. Term premiums reflect average rate for a 20-year-term.

Common misconceptions about permanent life insurance

Permanent life insurance can sound appealing, but there are a few misconceptions around value that might be misleading you. Before you make a final decision, here are three common permanent life insurance myths — and the real facts.

Myth 1: Permanent life insurance is always a good investment

It is true that permanent policies include a cash value component that typically grows tax-deferred at a guaranteed rate. However, this doesn’t mean the returns are great. In fact, most cash value returns are modest, and you may need to pay tax if you withdraw from the cash value or if interest accumulates from a loan.

In terms of returns, you’re probably better off choosing a traditional investment vehicle like a TFSA or RRSP, alongside an affordable term life policy.

Myth 2: A guaranteed payout makes permanent life insurance more valuable

Permanent policies do offer guaranteed payouts, but there’s a catch: the premiums are so high (up to 15 times more than term life) that some policyholders end up paying close to or even higher than their death benefit amount by the time the policy pays out.

In terms of value, a term life insurance policy can help keep costs down, giving you the flexibility to invest your savings for a return with higher value.

Myth 3: Cash value is “free money”

You can borrow or withdraw from the cash value in a permanent policy, but it will cost you. Borrowing from your cash value can reduce your coverage, create a tax bill, or even cancel your policy if mismanaged.

It’s dangerous to think of cash value as “free money.” Withdrawals above a policy’s adjusted cost basis are taxable, and the same goes for loans if your policy lapses or is surrendered with an outstanding loan balance. If the debt exceeds your cash value, your policy can collapse, leaving you with no coverage.

FAQ: Permanent life insurance in Canada

Jaya is a researcher and writer with 3 years of experience in insurance and finance. She writes in-depth content that bridges technical expertise with accessible insights. Her work spans topics such as life insurance, health and dental coverage, car insurance, and financial literacy, helping Canadians make informed decisions about their financial protection. With a background in market research and editorial strategy, she collaborates closely with subject matter experts to ensure accuracy, clarity, and value in every piece.

Jaya is a researcher and writer with 3 years of experience in insurance and finance. She writes in-depth content that bridges technical expertise with accessible insights. Her work spans topics such as life insurance, health and dental coverage, car insurance, and financial literacy, helping Canadians make informed decisions about their financial protection. With a background in market research and editorial strategy, she collaborates closely with subject matter experts to ensure accuracy, clarity, and value in every piece.