Mortgage Insurance vs Life Insurance: Which Is Better?

Term life insurance can give you the same protection as mortgage life insurance, with more flexibility and at a lower cost. Let’s get into the reasons why it’s a better choice for most Canadian families.

What is mortgage life insurance vs. life insurance?

Both mortgage life insurance—also known as mortgage protection insurance—and life insurance can protect your spouse and kids if you pass away. But, while mortgage life insurance pays the bank or lender directly, life insurance offers a tax-free lump sum to your beneficiaries (your family members) that can cover the mortgage and other expenses.

What is mortgage life insurance?

- Mortgage life insurance is an optional insurance policy you buy through your bank or mortgage provider that is tied directly to your mortgage.

- The premiums you pay for mortgage life insurance are based on your age and mortgage amount.

- The premiums you pay are usually added to your monthly payments and stay the same over time, even as your mortgage debt decreases.

- If you pass away and there is still a balance on your mortgage, the provider will pay off the amount owing and your family will own the house outright.

What is term life insurance?

- Term life insurance is a type of policy you can buy through an insurance company.

- You decide how long you want your policy to last (typically 10, 20 or 30 years) and how much coverage you need.

- People usually choose their coverage amount based on their current and future financial obligations, like their mortgage and other debt, and the cost of raising their kids and putting them through school.

- If you pass away, the life insurance company pays the coverage amount—also called the death benefit—to your beneficiary, which is usually your spouse or kids.

Watch the video below to learn about how term life insurance is different from mortgage life insurance.

Do I need mortgage insurance if I have life insurance?

Generally, no; you don’t need mortgage life insurance or mortgage protection insurance if you already have life insurance. A term life insurance policy payout can cover your mortgage and provide greater flexibility, control, and overall value.

While mortgage life insurance only pays the remaining balance directly to your lender, life insurance gives your beneficiaries a tax-free lump sum they can use however they need, from paying off the mortgage to covering funeral costs, education, or day-to-day living expenses.

How long do mortgage life insurance and life insurance last?

The longevity of your mortgage or life insurance policy will depend on a few factors. Mortgage insurance will last as long as you owe money on your home (20 to 30 years), while you can choose how long your term life insurance policy will last.

- Mortgage life insurance lasts as long as you have outstanding debt on your mortgage. Once it’s paid off, or if you move to a different lender, the insurance policy ends.

- Term life insurance has flexible timelines, such as 10, 20, or 30 years. If your amortization period is 20 years, for example, you can get a 20-year policy that will cover you for that time.

What do mortgage life insurance and term life insurance cover?

Mortgage life insurance and term life insurance can both cover the outstanding mortgage on your house in the unlikely event that you pass away. However, term life insurance can also cover additional expenses, and the death benefit payout goes directly to your beneficiaries, not to the bank or mortgage lender.

Let’s take a closer look at the coverage details for mortgage life insurance and term life insurance.

What mortgage life insurance covers

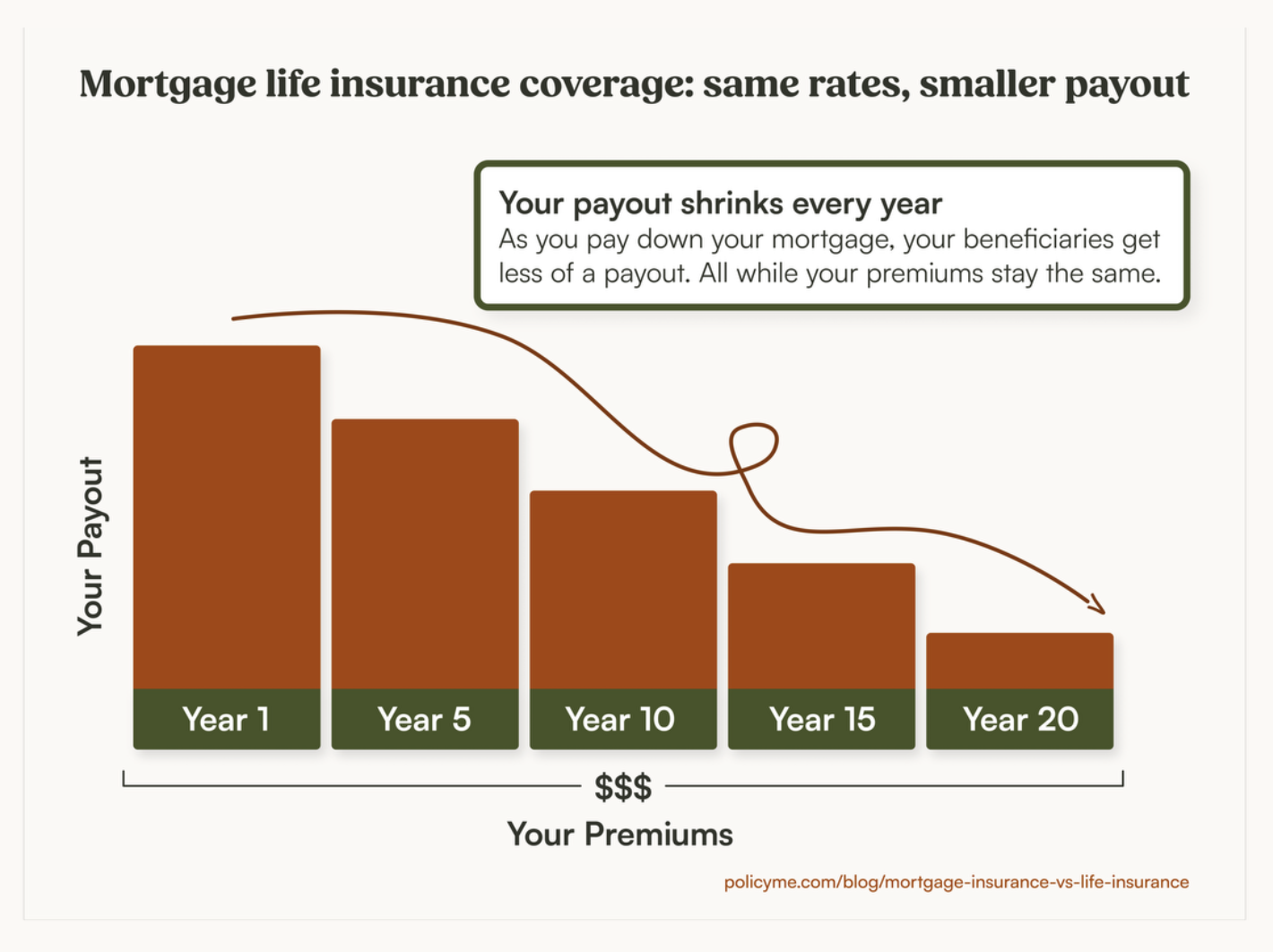

Mortgage life insurance can only be used to pay off your mortgage. As you pay off your mortgage, the death benefit decreases but your premiums stay the same. Here are some key features of mortgage life insurance coverage:

- Benefit value: The benefit amount from mortgage life insurance will be equal to the remaining balance on your mortgage, which means it decreases over time as you’re paying it off.

- Payout receiver: When you buy mortgage insurance, any payout will flow out to your mortgage lender, not to you or your family like term life insurance does.

- Transferability: Mortgage insurance is linked directly to the mortgage you purchase the policy for, so it can only be used to pay off the loan on that home. If you pay off the mortgage, switch lenders, or sell your home, the coverage will typically be cancelled.

“With mortgage life insurance, the death benefit is paid to the bank and your family doesn’t ever see the money.“ – Laura McKay, Certified Life Insurance Advisor and COO and co-founder of PolicyMe.

What term life insurance covers

The payout for a term life insurance policy, also known as the death benefit, is provided to your beneficiaries if you pass away within the term period of your policy. The death benefit can cover the balance on your mortgage, help with funeral expenses, pay for private school or post-secondary education, handle medical costs or go into a retirement fund for your spouse.

If you’re ready to take the next step to protecting your mortgage and family, it may be wise to look at Canadian term life insurance plan options and rates. You can start with PolicyMe, which combines flexibility and affordability, making term life insurance accessible to Canadian families of all kinds. Get a no-obligation life insurance quote and start your application in a few clicks.

Cost of term life insurance vs mortgage insurance

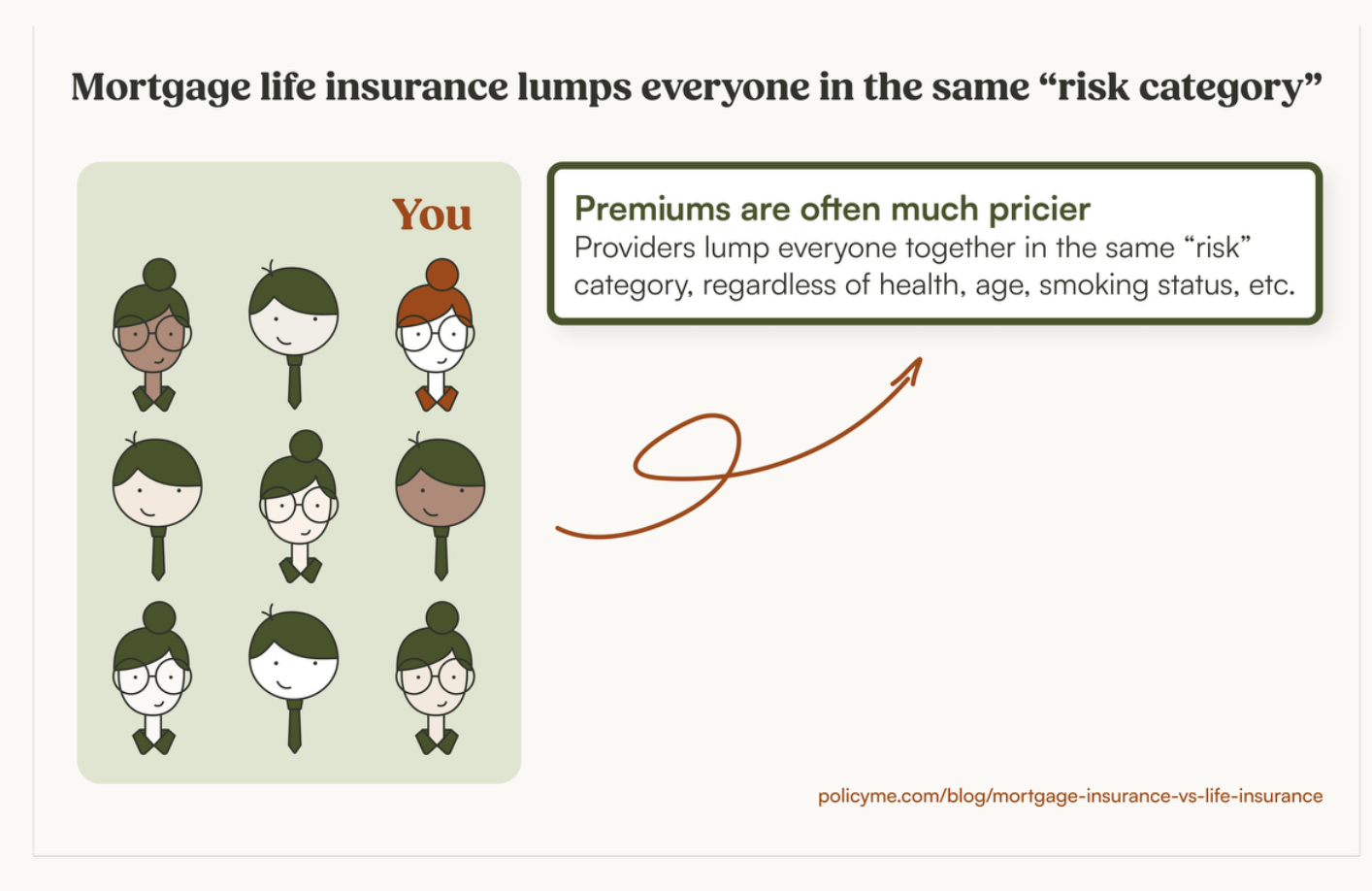

Typically, mortgage life insurance premiums are usually more than double the amount you'd pay for term life insurance. Here are the main factors that contribute to the cost of mortgage insurance:

- Age: Like with most types of life insurance, the older you are, the more expensive your premiums will be.

- Mortgage value: The same goes for the mortgage amount; the more you owe, the more insurers will charge you for premiums.

Additionally, mortgage life insurance policies aren’t underwritten, meaning they don’t consider your individual risk. So even if you’re a healthy person without high-risk hobbies, you will likely overpay for insurance if you choose a mortgage insurance policy.

An important note on mortgage life insurance cost: It stays the same, regardless of the amount of your mortgage balance. So you don't pay less as you pay off your mortgage, even though the payout shrinks with every mortgage payment.

As an example, we’ve compared average starting monthly premiums for term life and mortgage life insurance products, based on a 20-year, $500K policy for a 35-year-old non-smoking woman:

Bottom line: Averaging out the cost over 20 years for mortgage life insurance to $18,020.80, you’d save $12,097.60 over 20 years with term life insurance.

Do I need a medical exam for mortgage insurance?

While you may need to answer a few health-related questions, medical exams are typically not required for mortgage insurance, making it a type of no-medical insurance.

The drawback to this approach? Mortgage insurance providers assume everyone has the same risk (high) and charges premiums accordingly. And since underwriting happens after a claim is made, mortgage insurers may deny the claim if you pass due to a pre-existing health issue.

What happens with mortgage insurance and term life insurance if you change mortgage providers?

If you change mortgage providers, your current mortgage insurance policy will end, and you won’t receive any form of payout from your provider. You will need to apply for a new policy with your new mortgage lender, which may come at a higher cost since you’ll be older.

Alternatively, if you change mortgage providers and you have term life insurance, your policy and death benefit will not be affected. Term life insurance stays with you no matter where your mortgage is held, so you can switch your home and lender, or refinance without any coverage or premium differences.

When is mortgage insurance a good idea?

For most families, mortgage life insurance isn’t the best option if the goal is broad, flexible protection. While mortgage insurance is designed to pay off your mortgage if you pass away, term life insurance typically offers more value, lower premiums, and greater control.

Mortgage life insurance may seem convenient, but it has major drawbacks: the payout goes directly to your lender, not your family, and the coverage amount shrinks as your mortgage is paid down, while your premiums stay the same.

If you have an existing health condition that makes it difficult to qualify for fully underwritten coverage, mortgage insurance might seem like an easy solution, but better options exist. Instead, consider simplified issue life insurance, which involves a short health questionnaire with no medical exam. And if that’s not an option, guaranteed acceptance life insurance provides coverage without any health questions at all.

Bottom line: term life insurance makes sense for most Canadian families

Term life insurance is usually the smarter option over mortgage insurance if you’re looking for a policy that offers consistent coverage and real control over your financial legacy. It provides broader protection and puts the payout in the hands of your family members, not the bank.

Here’s a summary of why term life insurance stands out:

- You choose your beneficiary, so your loved ones receive the payout, not your lender.

- The coverage isn’t limited to your mortgage; it can be used for anything from debt repayment to funeral costs, helping your partner maintain their lifestyle.

- Premiums remain fixed for the length of your term (often 20 or 30 years), while mortgage insurance premiums reset and increase each time you renew your mortgage.

- Since it’s not tied to your lender, coverage continues even if you refinance or switch mortgage providers.

- The death benefit never decreases, so your beneficiaries will receive the full payout regardless of when a claim is made.

FAQ: Life insurance vs mortgage insurance in Canada

*Life insurance rates in this article are based on publicly available premiums.

Jaya is a researcher and writer with 3 years of experience in insurance and finance. She writes in-depth content that bridges technical expertise with accessible insights. Her work spans topics such as life insurance, health and dental coverage, car insurance, and financial literacy, helping Canadians make informed decisions about their financial protection. With a background in market research and editorial strategy, she collaborates closely with subject matter experts to ensure accuracy, clarity, and value in every piece.

Jaya is a researcher and writer with 3 years of experience in insurance and finance. She writes in-depth content that bridges technical expertise with accessible insights. Her work spans topics such as life insurance, health and dental coverage, car insurance, and financial literacy, helping Canadians make informed decisions about their financial protection. With a background in market research and editorial strategy, she collaborates closely with subject matter experts to ensure accuracy, clarity, and value in every piece.