Borrowing Against Life Insurance Canada: Money Hack or Risky Move?

How does borrowing money against life insurance work in Canada?

Borrowing against life insurance means that you are taking out a loan using the cash value of your existing permanent life insurance policy as collateral.

Who is the lender? Your insurer or some other third-party lender can issue the loan.

What types of policies can you borrow against? Only whole life and universal life policies (permanent life insurance) accumulate cash value that can be borrowed against.

How much can you borrow? How much you can borrow depends on how much cash value your policy has built up, which can take many years. Each premium you pay contributes to this cash value, which grows over time at the interest rate set in your policy.

What are the drawbacks of borrowing against life insurance? If you don’t pay back what you owe or it could cut into the policy’s death benefit or cancel your coverage altogether.

You can only borrow against permanent life insurance

Term life insurance cannot be borrowed against. That’s because term policies do not include any investment or savings component that accumulates cash value.

Permanent policies (whole and universal) are the only life insurance policies that accrue a cash value over time and that can be borrowed against. Your life insurance premiums add up and a portion of them are invested, and you can technically make withdrawals or borrow against the value.

Life insurance is ultimately about protection, not investment. There are better ways than permanent life insurance to access cash and get a loan.

Permanent life insurance isn’t a good fit for the majority of Canadians for two main reasons.

- Cost: Whole life insurance coverage is 5-15x more expensive than a term policy.

- Duration: You’ll be locked into paying steep premiums for life, and since most people can’t keep up with the costs, the majority of whole life policies lapse before ever paying out.

Despite what TikTok financial influencers might say, “Whole and universal life insurance aren’t worth it for the majority of Canadians” according to Erik Heidebrecht, a Certified Life Insurance Advisor.

What are the steps to borrowing against life insurance?

First of all, what kind of policy do you have? You can only borrow against your life insurance policy with whole life insurance or universal life insurance policies.

Here’s how borrowing against life insurance works in Canada:

- The cash value in your policy must be sufficient to support the amount you want to borrow.

- You take out the money as a loan, but loan interest accumulates on the loan balance that must be repaid.

The best part? This kind of loan does not require a credit check because the insurer already holds the collateral.

The worst part? If you don’t repay the balance, the outstanding loan is counted against your death benefit and reduces the final payout.

Example: Using a policy loan correctly for short-term cash flow

Maria is 52 and has a whole life policy she bought 15 years ago. She needs $20,000 for an unexpected home repair, and her policy’s cash value is $60,000. She borrows against her policy rather than applying for a personal loan. She’s confident she can pay it back and repays it gradually over several years.

And here are some examples where borrowing against your life insurance policy would be a bad idea:

- The money was going toward a risky business investment

- There’s low confidence you could pay it back

- You could borrow money elsewhere at a lower interest rate (like a HELOC or a TFSA)

Here’s a deeper explanation of cash value life insurance.

Is borrowing against life insurance a good idea?

No, borrowing against your life insurance is generally not a good idea.

Think of it like this: You should not borrow against your life insurance policy if your primary reason for having a policy is to protect your loved ones.

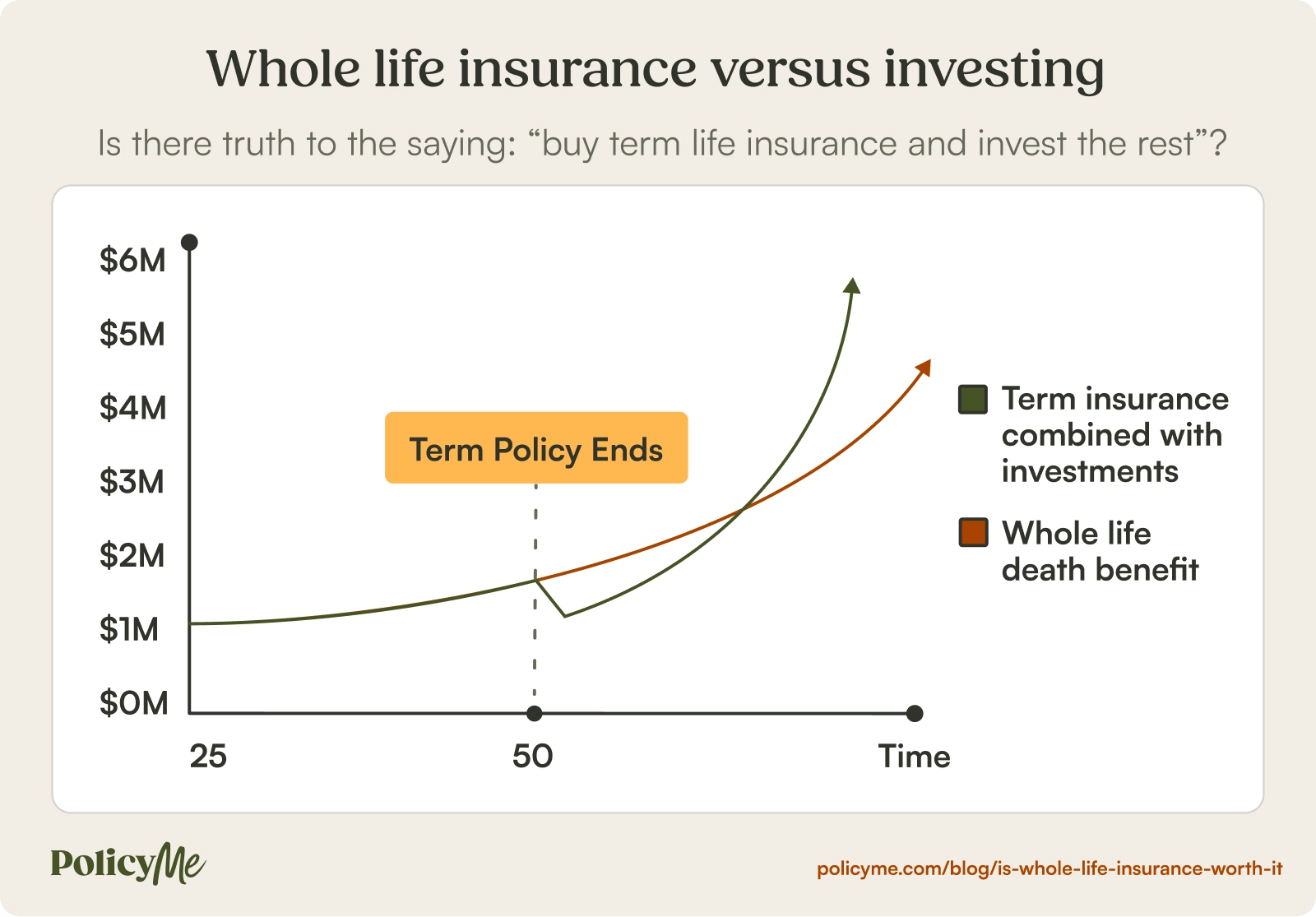

From a financial perspective, remember when comparing whole and term life insurance that there’s a huge price difference in the premiums. Term life insurance costs much less than permanent coverage, and the premiums don’t last your whole life.

For the average Canadian family, term life insurance is a better idea because it frees up more cash now that can be put into other types of investments (like a TFSA) that are basically guaranteed to earn more money than an expensive life insurance policy.

Pros & cons of borrowing against life insurance

The decision to borrow against your life insurance policy has some advantages, like access to cash. However, there are serious risks, like reducing your death benefit.

Is whole life insurance worth it?

Borrowing against life insurance is possible, but for most Canadians, getting a whole life policy is not the best financial strategy.

Permanent policies are best for families who need lifelong coverage for dependents who need permanent care or when there are wealth transfer concerns — it’s not generally the best strategy for people who may simply want to borrow against the cash value. Better alternatives exist.

The chart below explains the cash access part of this (and why other investments might be better, depending on your needs).

Why you should consider term life insurance instead

Term life insurance is the best option for most Canadians who want to purchase life insurance to protect their loved ones from financial hardship if they were to pass away.

With a term life insurance policy, you don’t have to worry about repaying interest on your own money or losing a death benefit because you find yourself unable to pay back what you borrowed. Plus, whole and universal life insurance policies cost more upfront, leaving you with less money to invest today in more profitable options.

In other words, term insurance can be paired with other savings and investment strategies (like TFSA/RRSP) to build borrowable cash value over time.

Take a look at the difference in returns.

In the bigger picture, term insurance gives you more control over your cash as your family’s needs change. Why tie up your funds in permanent policies that may not be worth it long-term?

With term life insurance, you're covered for the term length you need, such as when your kids are young and financially dependent on you.

How soon can I borrow against my life insurance policy?

You can borrow against your life insurance policy as soon as your policy has built up enough cash value to do so. It typically takes at least 10 years for policyholders to accumulate enough cash value, but the exact timeframe depends on the type of policy.

What is the interest rate on a life insurance loan?

Interest rates on a life insurance loan are typically between 5-8%. However, the rate varies depending on the life insurance company you’re with, your policy’s terms, and whether your interest rate is fixed or variable.

How much can you borrow against your life insurance policy?

Most providers allow you to borrow up to 90% of your cash value of the policy. Every insurer has different rules for the loan amounts available with policy loans.

Make sure to do your research. Look up the best life insurance in Canada or compare life insurance quotes.

FAQ: Can you borrow against life insurance in Canada?

Bonnie Stinson is an insurance writer and researcher in Toronto with a decade of experience producing helpful, accurate content for Canadians. They have published resources for some of Canada's most innovative and consumer-trusted companies in the health, legal, and fintech sectors.

Bonnie Stinson is an insurance writer and researcher in Toronto with a decade of experience producing helpful, accurate content for Canadians. They have published resources for some of Canada's most innovative and consumer-trusted companies in the health, legal, and fintech sectors.